8 top tax tips for freelancers

When you’re self-employed or freelancing, tax, inevitably, becomes part of your life. Whilst it might seem boring, complicated and more hassle than it’s worth, it’s something we all need to get on board with. But fear not! We’re here to help.

At TaxScouts, we firmly believe that doing a tax return should be simple, quick and, most importantly, hassle-free. So here are 8 tips for freelancers to make that happen.

Get to know the key tax dates

One of the most important ways to stay organised and avoid any penalties is to know when in the year HMRC expects you to take action. Here are some key dates to get in the diary:

- 6th April - 5th April - the tax year

- 5th October - the deadline to declare your income (Self Assessment) to HMRC

- 31st January - the deadline to pay your tax return

- 31st July - the deadline to pay the second half of your tax bill (Payment On Account)

Keep track of expenses

Did you know that when you’re self employed, you can deduct your business spend from your income? The rule that HMRC applies is as follows: anything that you spend wholly, exclusively and absolutely on your business can be deducted when it comes to calculating your tax bill. That way, you only pay tax on your profits rather than from your overall income.

Expenses could be anything, including things like:

- Your work phone and laptop

- Utility bills and rent for the premises

- Accounting costs

- Uniform (e.g. specialist shoes, protective clothing, overalls etc.)

- Equipment (e.g. design software for a graphic designer, kitchen equipment, electronics)

- Interest payments for a credit

- Business mileage and travel (not including a regular commute)

As long as you have evidence of your purchase and you can justify it as a sole business expense, you can deduct it from your tax bill. So keeping track of these in your yearly spreadsheet is really important. And speaking of which...

SPREADSHEETS!

Organisation is key when it comes to keeping your finances in order and, when it comes to your taxes, it’s even more important! As you will probably know, there are lots of tools and programmes to keep on top of your money, but even the most simple spreadsheet goes a long way.

Keeping a spreadsheet is a great way to store all your records in one place, which is particularly useful if you have more than one stream of income e.g. side gigs alongside a bigger contract role. Also, creating monthly tabs for each tax year, with all income and expenses recorded, makes pulling everything together to do your tax return much less of a hassle.

Get to know the tax reliefs you might be entitled to

Whether you’re employed or self-employed, you’ll be entitled to certain tax reliefs that are useful to be aware of:

- Reduce the tax you and your partner pay with the Marriage Allowance

- Claim back Gift Aid on your donations

- Claim back your mileage

- The Home Office Allowance

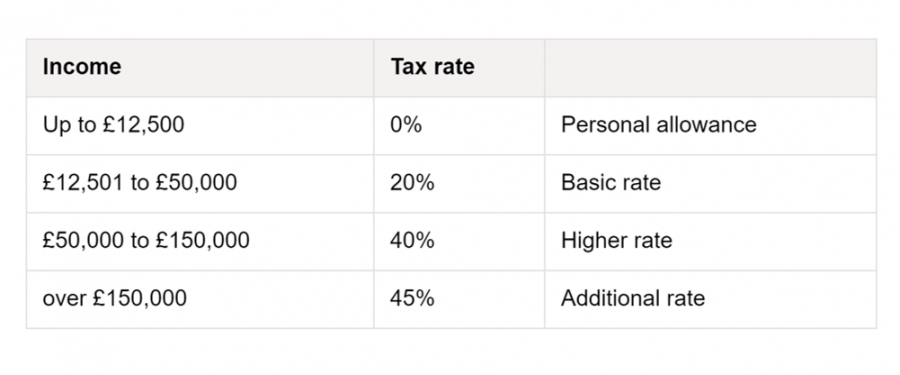

Get to know how Income Tax works

Income Tax is the tax that you owe on your earnings. It’s calculated based on how much you earn and, as you can imagine, the more you earn, the more Income Tax you pay.

Keep 30% of your income aside for taxes

With the above in mind, you should try to prepare for your tax bill from the earliest point possible. Being self-employed is very different to being salaried and living from paycheck to paycheck is a very risky strategy.

When you earn less than £50,000 per year, you’ll be taxed Income Tax at 20%; if you earn over £50,000 per year, you’re taxed at 40%. Therefore, it is wise to set aside 30% of your monthly income to cover your taxes. That way, you’ll be in a good position by 31st January to pay your tax bill without being floored by any unfortunate surprises.

Consider contributing Class 1 National Insurance

National Insurance is another type of tax that you need to pay on your tax return. It entitles you to certain state-provided benefits, such as the state pension, Maternity Allowance, Disability Living Allowance and more.

As a freelancer, you’re only liable to pay two types of it:

- Class 2 National Insurance - a flat rate of £159 per year when you earn more than £6,475 a year;

- Class 4 National Insurance - 9% of your earnings when you earn more than £9,501 per year.

However, with everything we’ve seen in the pandemic and considering how vulnerable you can become as a freelancer without employment support, it might be worth considering contributing to Class 1 National Insurance. It makes you eligible for the Job Seeker’s Allowance which, otherwise, you’re not entitled to claim.

Expect the best, prepare for the worst

Like we said all along, preparation is key. And we have three bits of advice to leave you with:

- Don’t leave everything to the last minute - that’s what makes tax stressful in the first place!

- Know how much you’ll owe in penalties if you file your tax return late. How? Try our late penalties calculator.

- Don't waste your money. Some traditional accountants thrive from the industry being needlessly complex, and from unsuspecting freelancers panic-buying their services. So don’t panic and shop smart.

At TaxScouts, we offer our services for a fair, flat fee and, as Freelancer Club members, you benefit from a further 5% discount. So sign up today to get paired with your own personal accountant. They’ll answer any questions you might have and guide you through the whole process, step-by-step.

To comment please sign in or register.