Choosing who to use to capture one of the biggest days of your life is a delicate process. Photographers vary in style, professionalism and price so finding your perfect match takes a little craft and guile. Here's our top tips on finding the perfect wedding photographer at the best price:

SURVIVING A FREELANCE CHRISTMAS

Christmas is just around the corner and, for freelancers, it tends to be a busy period or deathly quiet. For the former, December can bring with it some financial anxiety as businesses start to slow down and work drys up. To help keep your spirits up and motivation high, here are a few ways you can get productive and continue to progress this December.

DOES CHATGPT HELP FREELANCERS LAND MORE JOBS?

Can you believe it's almost been an entire year since ChatGPT launched it's consumer-facing tool? It appears that the initial frenzy has subsided and while some freelancers have warmly welcomed Chat GPT into their routines, others have discovered its boundaries. Job applications, a promising frontier for AI assistance, is a topic we are particularly interested in at Freelancer Club HQ but has it helped or hindered freelancer's applying for jobs? Let's delve into the results and find out.

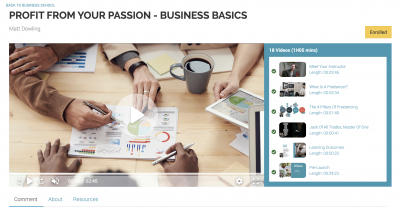

WHAT'S YOUR FREELANCE BUSINESS LEVEL?

Freelancing is sky-rocketing. More people and companies are hiring freelancers than ever before and there is a real opportunity for talented individuals to earn a living or generate extra income from their skills and passion. It’s not just the financial rewards either. Many are interested in freelancing for more control and flexibility in their lives. Some choose to run a business to improve their work-life balance and be their own boss. The benefits are endless and yet a large proportion of new freelancers struggle to earn enough to make it past the first year of business.

GUESS WHAT, FREELANCERS? IT'S OKAY TO BE VULNERABLE

Hey there mi familia, how the hell are ya? It’s been a while. Just shy of 2 months ago…I was in a pretty different mindset and this last Freelancer Club piece came pouring out of me. I was pissed, I was done, I was over it. I had an axe to grind with the bullsh*t us highly-skilled, hardworking freelancers deal with on a daily basis from the snobbery in society that looks down upon us from its ivory-tower. Like a loyal boxing coach, I stood proudly by the freelancer’s corner for yet another fight. Actually, oh contraire…I put the gloves on and entered the ring myself. This was my fight, and I felt indomitable.

HOW TO FIND FREELANCE WRITING JOBS IN 2025

How to Find Writing Jobs in 2025 The writing profession is evolving rapidly in 2025. While AI tools have changed workflows, demand for skilled human writers remains strong in copywriting, journalism, content marketing, technical writing, and ghostwriting. This guide covers practical strategies to find freelance writing jobs, build credibility, and adapt to the AI-driven landscape.

JUMPING INTO THE DEEP END WITHOUT A LIFEJACKET

Notice the word I use in the title? I don’t say thrown into the deep end. I say jump. That implies it’s done voluntarily. It’s done with ownership and accountability. Once you make that leap and enter the water — you have zero excuses. You are either a victim or victor to your own ego. Nobody threw me in against my will. I threw myself in. I may have well ignored all the advice, all the warning signs…as I know I’m a good swimmer

HOW TO FIND FREELANCE VIDEOGRAPHY JOBS

How to Find Freelance Videography Jobs Whether you’re breaking into video production or scaling your client roster, this guide covers the practical steps to find freelance videography jobs consistently: building a magnetic portfolio, choosing the right platforms, pricing for profit, and using AI-era tactics that clients value.